Why we invested in Ruedata?

We are proud to announce our new investment in Ruedata, a one-stop-shop platform for vehicle tire solutions. With operations in Mexico, Brazil, and Colombia, the company has integrated all the necessary solutions for comprehensive fleet tire management: from specialized SaaS, personalized maintenance planning and tire checks and marketplace. Through the use of data analytics and machine learning on all tire management data, the company achieves an average of 30% savings for its clients. As the solution extends the lifespan of tires it brings greater efficiency to the road transport sector while promoting significant carbon emission reduction, aligning with Barn’s Greentech thesis.

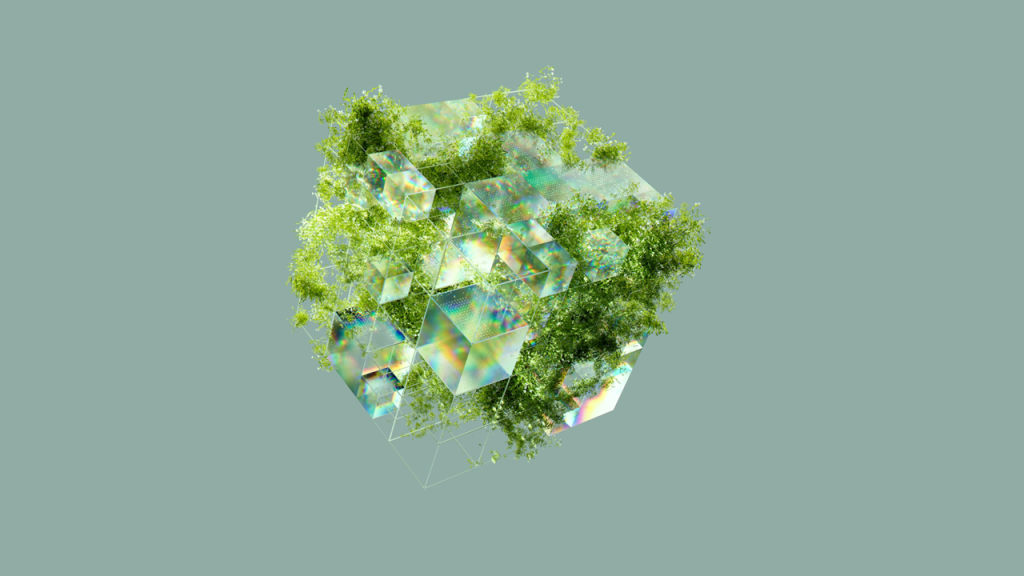

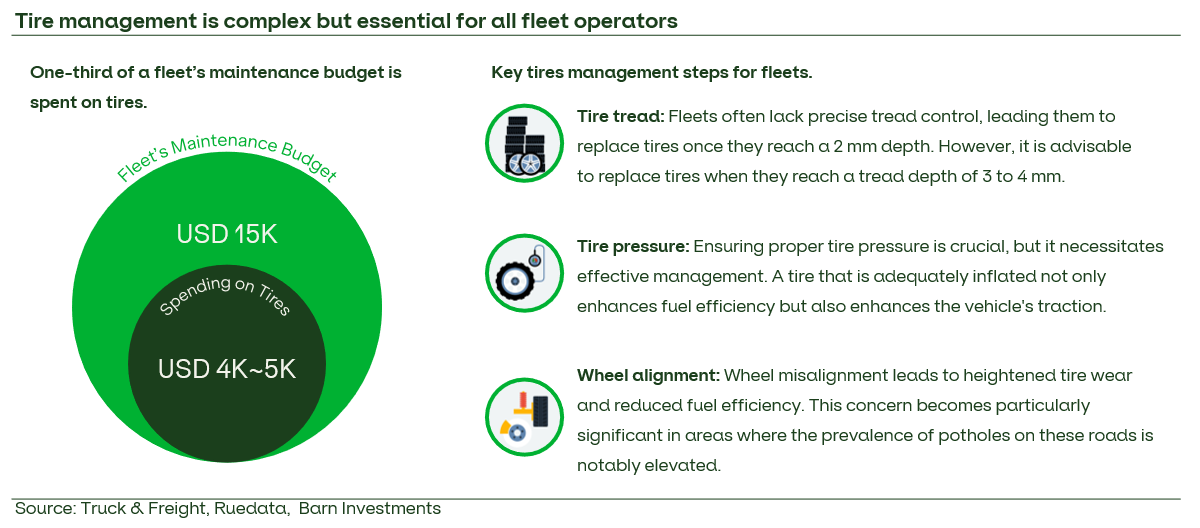

Investing in a tire solution is highly relevant when considering four main points: (i) road transportation plays a fundamental role in the logistics of Latin American countries. (ii) the commercial vehicle fleet in Latin America totals 34 million vehicles; (iii) all vehicles use dozens of tires each year (some commercial vehicles use up to 34 tires each); (iv) and finally, tires account for approximately one-third of all vehicle maintenance expenses. Considering all these factors, we realize that a cutting-edge tire solution has significant relevance and room for growth in Latin America.

After years of studying opportunities in Logistics vertical and closely monitoring Ruedata for nearly one year, we are confident in leading the USD 2M funding round for the most comprehensive tire management solution in our region. In this article, we will provide an overview of our insights and expectations for this investment based on three key points:

- A very large and relevant market for Latin America;

- Ruedata’s one-stop-shop solution has significant avenues for growth;

- The economic, operational, and environmental impact that the solution promotes for fleet clients.

-

1. A very large and relevant market for Latin America

The road transport mode is essential for Latin American countries. In Brazil, trucks are responsible for approximately 65% of the internal freight transportation, a figure closely matched by Argentina, where trucks constitute 66% of the nation’s transportation fleet. In Mexico trucks account for 70% of internal freight transportation, while in Colombia, the figure rises to 81%.

The commercial vehicle fleet in the LatAm region totals 34 million vehicles. Of this total, Brazil and Mexico have the largest fleets with 8.2 million and 11.0 million commercial vehicles, respectively. All vehicles require constant maintenance, considering that commercial vehicles can cover tens of thousands of kilometers every month.

Tires maintenance represents a significant portion of vehicle upkeep costs, accounting for one-third of total expenses. On average, commercial vehicles allocate U$ 15,000 yearly to maintenance, with a substantial U$ 5,000 of this directed towards tires. This expense is notable considering that trucks are equipped with 22 to 32 tires. The costs for new tires averages at U$ 440, highlighting their importance not only in terms of initial investment but also due to the frequency of wear and replacement. Given that tires have a lifespan ranging from 60,000 and 80,000 kilometers and commercial vehicles cover an average of 8,000 kilometers per month, regular tire replacement becomes a necessary and recurrent expenditure.

There is also a market for retreaded tires as a way to extend their lifespan. The retreading process focuses on renewing the tire’s tread, the part most susceptible to wear, by replacing the worn-out rubber without modifying the tire’s other components. Suitable for all tires, retreading is economically advantageous, costing between USD 80 and USD 140 per tire – significantly less than purchasing new ones. Furthermore, a tire can undergo retreading up to two times, potentially extending its service life by an additional two years.

Considering these insights, it becomes evident why the tire market in Latin America is experiencing robust growth, boasting an impressive annual value of $35 billion within the commercial sector. Brazil and Mexico stand out as major players, contributing 28% and 30% to the market, respectively. This highlights the critical role these countries play in the region's tire industry dynamics.

-

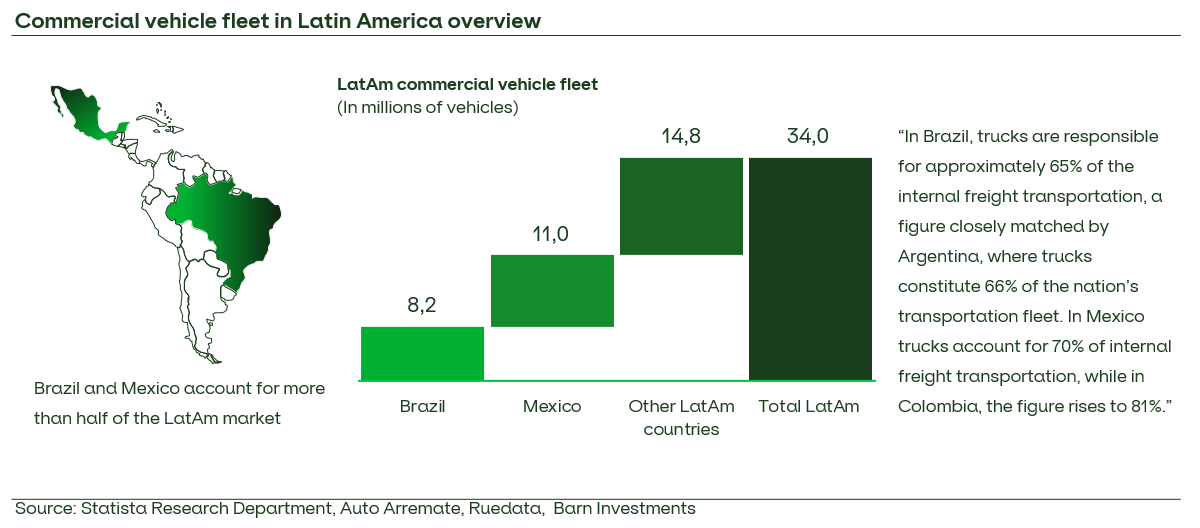

2. Ruedata's one-stop-shop solution has significant avenues for growth

Ruedata has established itself as the leading solution for tire management in Latin America. The company was founded in October 2017 in Colombia, but shortly thereafter, it began its operations in Mexico, led by two entrepreneurs with deep expertise in the tire industry. Both founders, Sebastian Baquero and Jorge Quinche, who serves as CEO and COO of Ruedata, bring with them the experience of importing Chinese tires for 5 years in Colombia, achieving significant milestones while building a network of over 100 distributors in 20 cities in Colombia.

The platform has evolved into a system that achieves a 30% reduction in tire-related expenses for fleet operators who adopt its services. Ruedata realizes significant savings through the integration of data analytics and machine learning applied to comprehensive tire management datasets. It goes beyond mere management checklists by providing clients with personalized reports, tire maintenance scheduling, and precise recommendations for the acquisition and handling of both new and retreaded tires.

The company has become an integrated platform that consolidates all the necessary solutions for holistic tire management. In terms of its business model, the company has three main revenue streams: i) SaaS model; ii) Maintenance service; and iii) Tires marketplace. Currently, the most significant revenue stream is the SaaS model, representing 75% of the revenue.

Ruedata has successfully introduced several key differentiators that set it apart in the market. A notable innovation is its proprietary gauge designed to assess tire condition. Where fleet operators once relied on importing such gauges from Europe, Ruedata now manufactures its own version, offering it at a cost that is nearly 10% of the imported gauge's price. Additionally, Ruedata's advanced software stands out by evaluating all facets of tire performance and providing actionable insights at a detailed level, tailored to each individual tire.

Another key factor setting Ruedata apart is the strategic partnerships it has forged in three countries with resellers. These alliances have bolstered Ruedata's commercial presence, particularly through collaborations with notable partners like Alelo and Ticket Log, who together boast a portfolio of over 1.5 million vehicles. Complementing this, Ruedata has witnessed a remarkable pilot conversion rate of around 80%. This indicates that new clients are experiencing significant benefits, including outstanding results and cost savings on tires, even during the initial trial phase.

-

3. The economic, operational, and environmental impact that the solution promotes for fleet clients

To demonstrate the confidence that Ruedata places in its value proposition and also prove the effectiveness of the solution within its clients, Ruedata offers a contract that guarantees a refund to clients who do not achieve a cost reduction of at least 2 times the amount paid to Ruedata within 8 months of operation, provided they follow at least 40% of the recommendations provided by the Ruedata platform.

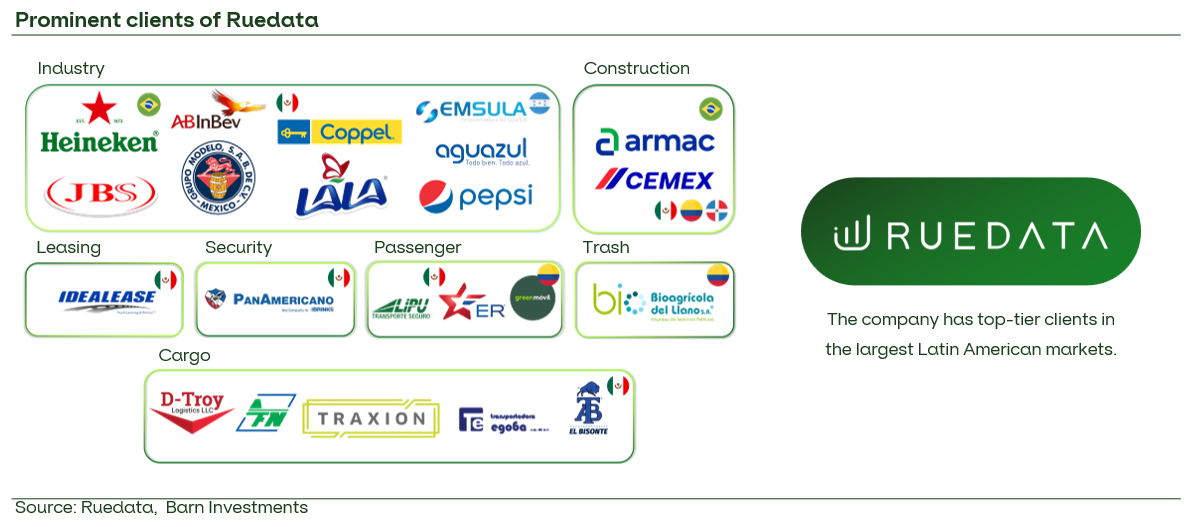

The company's clients have achieved an average ROI ranging between 6X to 8X, with some cases reaching an incredible 20X ROI. Thus, Ruedata has a prestigious client portfolio, including names such as Heineken, Grupo Modelo, JBS, Coca-Cola, Cemex, Riachuelo, Armac, among several others. Each client receives an action plan is tailored according to the clients' fleet profile.

From a broader perspective of the environmental impact promoted by Ruedata, the company has already analyzed over 400,000 tires to date, contributing to a reduction in emissions of approximately 131,000 tons of CO2.

Ruedata more than doubled its monthly revenue between January 2023 and January 2024, and we believe the company is on the right path to accelerate this growth throughout 2024. We are very enthusiastic about the company's next steps, knowing that there are many avenues for growth and a massive market to be transformed.

Looking Forward

Solutions that bring efficiency to the logistics chain are crucial for Latin America. The road modal, in particular, is the main driver of transportation and distribution of food and goods in general, directly impacting important aspects such as food security in the region. The transportation sector is also responsible for a significant portion of CO2 emissions; in Brazil, this sector accounts for 47% of all CO2 emissions in the country. To promote a transition to a greener economy, solutions that bring efficiency and cost reduction to fleets are essential.

Ruedata has a long path ahead, but it is on the right track to establish itself as the best and most comprehensive tire management solution in Latin America. The combination of an exceptional team with a unique product in the market, in a segment that generates USD 35 billion annually and lacks integrated tire management, appears very promising.

Barn Investimentos; Leading the Green Transition.