Agrolend: capacitar os PMEs para uma agricultura mais sustentável

Barn Investimentos invested in Agrolend at the beginning of 2021, when it was still pre-operational believing in the execution capacity of a skilled team of founders and understanding the massive opportunity, and challenge, that exists in serving financially, the huge and underbanked small and mid-sized farmers (SMFs) ag market in Brazil.

In less than a year, Agrolend has delivered impressive results: the Company raised a R$ 40 million FDIC, received its SCD license (government authorization to carry out credit operation through e-platforms), and deployed a significant number of loans across the country, partnering with several agents in the ag space.

This newly raised USD 14 mm equity round led by Valor Capital and followed by BARN Investimentos, Continental Grain Company, SP Ventures e Provence Capital is an important step for Agrolend in its path to become Brazil’s most important Ag bank, serving SMFs through credit and other services.

In this brief article, we share a few insights into our investment rationale in Agrolend.

Agrolend is within Barn’s GreenTech Vertical 1: Ag & Land Use. In Brazil, as in many developing countries, small and mid-size farmers face several challenges in accessing financial credit and funds. As a result of low access to capital, SMFs are generally less competitive, less efficient, and more financially strained, resulting in an inefficient use of resources. The lack of capital also strains production capacity generating more loss, more waste, and overall, more vulnerability to unpredictable events such as those caused by climate change.

Brazil: a global agriculture powerhouse

It is widely known that Brazil is one of the largest food producers in the world, and the largest exporter of coffee, sugar, orange, soy, and animal protein.

However, what is less known, is that SMFs have a vital role in Brazilian (and hence the world) agricultural production.

Accessing rural credit in Brazil

Access to capital is imperative to a more efficient agriculture. With capital, producers can properly plan and finance their production, buying the necessary inputs, contracting technical assistance, adopting technology, and accessing financial protection through crop insurance. However, only 15% of all rural establishments in Brazil have access to credit, of which 53% are government credit lines. On top of that, farmers must cut through a lot of red tapes to obtain credit lines with decent interest rates (which have been increasing lately). It is estimated that by 2025, pent-up demand for rural credit will reach BRL 200 bi.

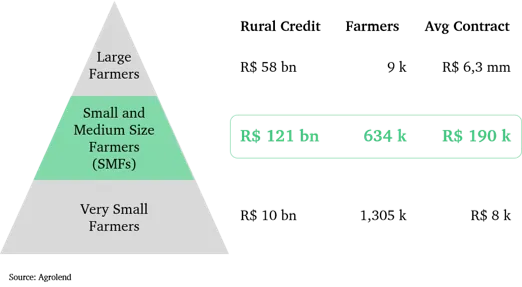

Agrolend is tapping into a BRL 121 bi rural credit market with more than 600K potential clients.

Product: How Agrolend is disrupting the rural-credit markets?

Funding and Distribution: Agrolend is conceding affordable credit to SMFs to allow producers to farm in a more sustainable, efficient, and competitive way. Its main distribution channel is through operational partnerships and agreements with the main regional Agri inputs distributors throughout the country. This co-distribution model creates scalability, as well as reduces credit risk, as the distributors are a significant guarantor (collateral) for the loans.

Agrolend’s process is agile, 100% digital, and bureaucracy-free. The UX has been developed specifically for SMFs, catering to their needs and available infrastructure.

Team

We have known the founding partners for many years. André (CEO) and Alan Glezer (CFO), are engineers who graduated from the University of São Paulo (USP) and have considerable experience in finance and in the ag- sector. The company’s CTO, Leopoldo Vettor, has a strong background in technology, with over 10 years of experience. Valeria Bonadio, CRO & CCO, is a seasoned professional, with over 20 years of experience in financial structuring and banking compliance.

Looking Forward

In a country like Brazil, where agribusiness represents over 20% of GDP and it is the 4th largest food producer in the world, rural credit undersupply is a major problem. The lack of capital for SMFs hinders productivity, restricting investments in technology (inputs, automation, technical knowledge), augmenting food insecurity, and delaying the implementation of best agronomic practices.

As the world population increases, so does the demand for food. Brazil is expected to play a key role, both as a food supplier to the world, as well as a technology innovator in food productivity. Capital is key to develop, implement, and scale a more efficient and sustainable agriculture. Understanding the local producers, the cultural peculiarities of the local market, and partnering with the main players in the sector is key to conquering this market…we believe Agrolend will be the one to do it!